Focus on Customers for Greater Profitability with the Retail STRATA:G® Wheel

(That's "strategy." Every retailer needs one!)

by Patricia M. Johnson and Richard F. Outcalt

“How are sales?” is essentially the universal greeting between retailers.

As retailers focus their attention on increasing sales, they ask, “How can I most effectively push for 'top line growth'?"

To answer that, we must first answer the question, “What drives retail sales?”

Is it the economy? Location? Advertising? Low prices?

No, not really. When it comes down to it, retail sales are driven by customers!

In our view, the key to survival in retail is not profitable lines of merchandise, nor even profitable stores. Instead, those retailers who will survive and thrive will be those who have the most profitable customers!

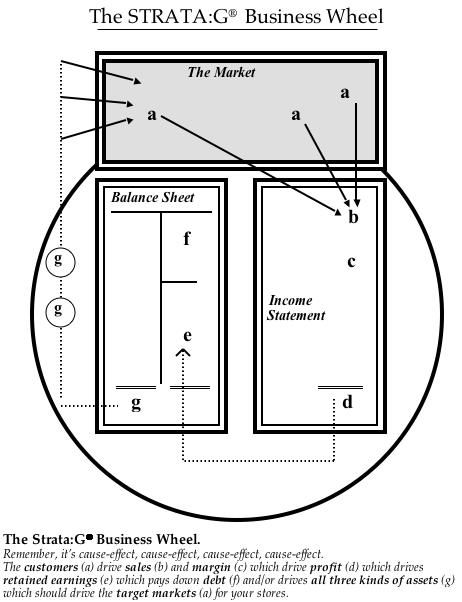

By using the Retail STRATA:G® Wheel to analyze and plan your business, you can refocus your store—not on merchandise or price, but on customers!

The Retail STRATA:G® Wheel merges strategic marketing with strategic financial planning.

By focusing on the customer who is most profitable for your business, you can more effectively make decisions about what financial changes can and should be made to maximize results and minimize risk.

The following is an example of how one retail business owner applied the Retail STRATA:G® Wheel to his store’s financial situation. We will refer to this retailer as Ralph. (This case is designed to teach the principles, not the specifics, of the Wheel.)

First, Gather the Facts

For the last twelve months, Ralph’s store generated $3 million in sales with 40 percent gross margin ($1.2 million). After operating expenses, taxes and owner’s draw, Ralph cleared a net profit of $30,000. That $30,000 was added to retained earnings, while changes in assets and liabilities were also entered on the balance sheet. (Take a look at these numbers in Figure 2.)

At this point, Ralph’s total assets were $1 million, of which inventory represented $600,000. The other side of the balance sheet showed $750,000 in liabilities and $250,000 in net worth.

Get MORE about profit management & growth

Now, Analyze the Situation

From our viewpoint, Ralph’s customer base and sales trend were the areas of greatest concern. Ralph’s $3 million in sales not only wasn’t growing, it was netting him only one percent: $30,000!

Like most retailers, Ralph knew a great deal about what he was selling but next to nothing about who was buying.

The market Ralph traditionally depended on was shifting away from him, and Ralph didn’t even realize it.

Another major concern was Ralph’s 3:1 debt-to-worth ratio ($750,000 in total liabilities divided by $250,000 in equity or net worth).

Generally, a debt-to-worth ratio of 1:1 is “bankable” and 2:1 is about as leveraged as a retailer can be.

At 3:1, with total liabilities of $750,000, Ralph was making less from his business than what he was paying in interest!

Worse yet, with such a high debt-to-worth ratio, if Ralph needed more working capital, he probably couldn’t get a banker to loan him a dime.

How to Find the Most Profitable Customers

For one week, Ralph and his staff asked each customer who entered the store to answer the question “Why do you shop with us?” The customers were given this list of answers to choose from:

A) You always have the merchandise I need/want.

B) The brands you carry.

C) I can use a charge account.

D) Helpful, knowledgeable staff.

E) I’ve just always shopped here.

F) Location.

G) Low prices.

H) Other.

Each response was noted along with the amount of the transaction, the frequency of shopping visits, and the customer’s ZIP code.

When the results were tallied, some very meaningful findings emerged.

What Ralph discovered was that the customers with the highest average purchases—the most “profitable” customers—came to his store not because it had a wide assortment of merchandise, but because the staff would patiently answer any question.

The results also confirmed that those shoppers with the smallest average purchases were the ones who cared most about price and least about brands. (These are the people who want “cheap steak” rather than “steak, cheap.”)

To the Rescue: The Retail STRATA: G® Wheel

The circular pattern of the Wheel made a powerful impression on Ralph:

Customers (a) drive sales (b) and margin (c) which drive profit (d) which drives retained earnings (e) which pays down debt (f) and/or drives all three kinds of assets (g) which drive the target market (a) for any store.

Not only did the Wheel show Ralph what to do and why to do it, it also helped him explain his decisions to his staff. And his banker!

©Copyright, The Retail Owners Institute® and Outcalt & Johnson: Retail Strategists, LLC.