by Patricia M. Johnson, CMC and Richard F. Outcalt, CMC

The Four (Only!) Ways Retail Businesses Grow

- Considering a multi-store launch?

- Opening additional locations?

- Testing a new retail concept?

- Launching a robust e-commerce site?

- Or, just trying to pull together a going-forward, post-2020 survival plan?

Each one of these approaches to survival and growth requires a rigorous process: develop your plans, explore real estate or web hosting opportunities, evaluate systems, identify mid-management talent, line up financing, and so on.

But wait! Before you get too far down the road on any of these areas, you first must decide on your fundamental growth strategy.

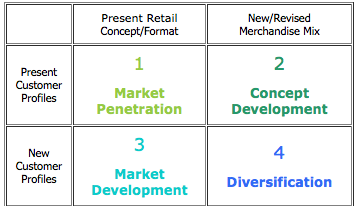

Why? Because your growth strategy and your tactics must align! Consider this chart. It summarizes the Dynamics of Retail Growth.

©Copyright, The Retail Owners Institute®.

Here are some reminders about how to read it:

a. There are just two major variables that affect a retailer's growth and expansion, displayed in a matrix:

- Customers (shown in the left-hand column)

- Merchandise Mix (shown in the top row)

b. Each of these two variables is further divided between

- what you have Now (e.g., "Present Customer Profiles", "Present Merchandise Mix"), and

- what would be New or different types of customers or merchandise mix.

Now, look at how these factors intersect with each other. (That's where the numbered cells – 1, 2, 3, 4 – on the chart come in.)

What this shows is that there are, fundamentally, only four ways that your business can grow. Each of those four ways involves a different combination of things as they are now, or new things. (Yes; we're using "things" as a technical term....)

It all depends on which combination of these variables you choose to pursue.

Knowing which way you intend to grow, or, when you are in the midst of a growth spurt, recognizing which variables are changing the most, gives you more opportunity to exercise leadership and apply controls.

Why does this matter?

Because change equals stress. Even "good change" involves added stress.

All of your resources – financial capital, and especially human capital – will be impacted.

Also, each of these four fundamental Growth Modes demands different amounts of changes. And therefore, different levels of stress...on your organization!

Growth Mode 1 – Market Penetration – requires no fundamental changes.

Growth Modes 2 & 3 – Concept Development and Market Development - each demand one fundamental change.

And Growth Mode 4 - Diversification - requires two fundamental changes.

Even more for growth-minded retailers

Growth Mode 1: Growth by Market Penetration

When you take your present retail concept and merchandise mix, and "roll it out" to similar types of customers by opening more store locations or venues, you are growing by Market Penetration.

The focus is on replicating your store concept/ format, or what now is often called making your retail operation "scalable."

Caution: you may be surprised to discover that opening additional stores across town or in another town, or launching an e-commerce website, may actually involve you in the Market Development growth strategy.

Why? Because the customers across town, and the online shoppers, can be very different from the customers served from your present storefront.

Growth Mode 2. Growth by Concept Development

Here, the focus is to change out the merchandise mix, or add to it, with categories that are logical extensions for existing types of customers.

This can have major impact on your Balance Sheet, as you add inventory.

Plus, impacts will ripple through your P&L as well. There will be increased training costs for your staff on these new products, plus advertising to attract the appropriate customers. While vendors may seem very generous with funds for training and advertising the new product lines, beware the hidden costs of over-buying.

Growth Mode 3. Growth by Market Development

Growing by Market Development is where many Growth-by-Market-Penetration plans often end up!

The customers across town, or online shoppers, can be very different from the customers served from your present storefront. This is where customer psychographics (a combination of demographics, lifestage, and values) are very important.

Follow the customer! Is your retail concept appropriate for college towns? Or county seats? Or hip urban neighborhoods?

Growth Mode 4. Growth by Diversification

Introducing a fresh concept to a market is an exciting opportunity. But be careful. Growing by Diversification – that is, taking a new or revised merchandise mix out to a new type of customer segment – is essentially a new retail startup!

If that is in fact your plan, more power to you. Just be shrewd about all of the implications for your operation. Be prepared to meet all the additional demands on financial and human capital.

Another caution: But all too often, retail organizations end up in a "diversification" mode without intending to be there.

For instance, when putting their merchandise on their website, they intend to simply provide another way for their customers to shop. Must be "Market Penetration."

But in fact, the folks who shop on the web frequently are very different from those who prefer to come into their stores. So, we have now slipped into "Market Development", needing to deal with new kinds of customers.

And...those new kinds of customers may want different products, too! Yikes! Now these retailers are also involved with new products and merchandise mix...which lands them in Diversification. Which can mean all sorts of stresses on their resources.

No One Right Answer!

Is one of these Four Ways to Grow better than the others? Or, is just one of them right for your stores?

No, of course not! In fact, when we ask retailers "Which way are your stores growing?", sometimes they discover they are trying to grow in two or three (or even four!) ways, all at once. No wonder they feel like the taffy in the taffy pull!

However, knowing which way you intend to grow (based on your analysis of your company's capacity and appetite for change), or, when in the midst of a growth spurt, recognizing which Growth Mode you are in, gives you the greatest opportunity to exercise leadership and apply controls.

©Copyright, The Retail Owners Institute® and Outcalt & Johnson: Retail Strategists, LLC.