The Myth of "the Bottom Line"

by Patricia M. Johnson, CMC and Richard F. Outcalt, CMC

Retail business owners are conditioned from day one to "have a profit" and "improve the bottom line." Vendors of all sorts tout their products and services as sure-fire ways to grow profits.

Yet, sadly, many owners are puzzled by questions like these:

What IS profit?

Where DOES it go?

WHY is it important?

Alas, these good questions have launched many myths. It's time to get to the bottom of all this!

The first thing to learn is that most retail businesses are on the accrual accounting system and, therefore, profit is not the same as cash.

Your profits—instead of going directly into your pocket—are more likely to help you grow your business by paying off debt, investing in store essentials and expanding your inventory.

Using The I. M Surviving (?!) Company as an example, let’s look at how profit is reinvested in your business. You’ll see how profit or loss affects your overall financial picture.

Profit Management—The Income Statement

To manage your profit effectively, start by examining your income statement, or profit and loss (P & L) statement. This statement reports the financial accomplishments of your store over a period of time, usually a year. It includes gross sales, related expenses and resulting net profit (or loss) for a selected period of time, as shown in the chart below.

I. M. Surviving(?!) Co. Income Statement

For the Period 1/1/XX - 12/31/XX

| Total Sales |

$1,000,000 |

| Cost of Goods Sold |

- 700,000 |

| Gross Margin |

300,000 |

| Total Operating Expenses |

- 280,000 |

| Operating Profit |

20,000 |

| Other Income (Expenses) |

- 10,000 |

| Profit (Loss) Before Tax |

10,000 |

| Income Tax |

- 2,000 |

| NET PROFIT |

$8,000 |

As you know, the last line of your income statement will show either a profit or loss. In this example, The Surviving Co. ended up with $8,000 net profit – but not necessarily $8,000 in cash!

What’s really important is this:

- where has this net profit gone?

- how does it affect the rest of this store’s financial picture?

Strength Management—The Balance Sheet

The financial strength of your store is not represented by sales nor even profit, but by the composition of your balance sheet.

The balance sheet is a “snapshot” of the financial condition of your store at a particular point in time, usually the end of your fiscal year. It lists what the company owns (assets), what the company owes (liabilities) and the difference between the two, which is the net worth (or equity) of the company.

The balance sheet’s structure is simple.

Assets represent the total amount of money you’ve invested in your business (cash, inventory, fixtures, etc.).

Liabilities are outstanding debts (bills, loans).

Equity is simply the difference between total assets and total liabilities. Think of equity as money not owed to anyone—the owner’s share.

It works the same way as your house. For instance, if your house is worth $300,000 (asset), and your mortgage (debt) is $200,000, your equity is $100,000 ($300,000 minus $200,000.)

Below is an example of The Surviving’s balance sheet for the end of last month.

I. M. Surviving(?!) Co. Balance Sheet

12/31/XX

| Assets |

|

|

Liabilities |

|

| Cash |

3,000 |

|

Trade Accounts Payable |

169,000 |

| Accounts Receivable |

80,000 |

|

Short-Term Notes Payable |

69,000 |

| Inventory |

250,000 |

|

Accrued Expenses |

40,000 |

| Total Current Assets |

333,000 |

|

Total Current Liabilities |

278,000 |

| Furniture & Equipment |

34,000 |

|

Long-Term Liabilities |

-0- |

| Accumulated Dereciation |

(12,000) |

|

Total Liabilities |

278,000 |

| Net Fixed Assets |

22,000 |

|

Equity |

|

| |

|

|

Capital Stock |

75,000 |

| |

|

|

Retained Earnings |

2,000 |

| |

|

|

Total Equity |

77,000 |

| |

|

|

|

|

| Total Assets |

$355,000 |

|

Total Liabilities + Equity |

$355,000 |

Get MORE about profit management & growth

Dispelling the Myth

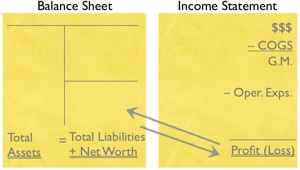

Now, let’s look at how the income statement and the balance sheet work together.

Returning to the income statement, we see that The Surviving Co. has a net profit of $8,000.

If you think the owners can write an $8,000 check from this ”profit” and take their families on nice vacations, you’re wrong. That $8,000 is an accounting illusion, existing only on paper.

So, where does it go?

Imagine a pipe running from net profit on the income statement to a bucket called “retained earnings” on the balance sheet. Your store’s retained earnings are part of the equity section of the balance sheet—this is where that $8,000 net profit (“bottom line”) goes.

Retained earnings adds profits to or subtracts losses from the balance sheet.

Remember—your balance sheet must always balance. Therefore, other numbers must change, too.

For instance, assets may have increased $8,000, so that’s really where the profit is!

This cause-effect-cause-effect connection dramatically affects the overall financial strength of a business.

Keeping A Balance

In review, when a business turns a profit, it shows up on the balance sheet as an increase in equity, called retained earnings. A loss would have the opposite effect—reducing retained earnings and equity.

The essence of management lies in how you balance your balance sheet.

Again, a balance sheet will always balance—it does so by definition.

But how you balance it is up to you. How you “use” your net profit is a vital owner decision.

Let’s look at Surviving’s balance sheet (below).

The Survivings had an $8,000 profit that increased retained earnings (equity) by exactly $8,000.

For The Survivings, the balance sheet now balances because the store owner bought more inventory ($2,000), invested in furniture ($4,000) and paid off a short-term notes payable ($2,000).

Therefore, the balance sheet balances by a $6,000 increase in assets, and a $2,000 decrease in liabilities.

I. M. Surviving(?!) Co. Balance Sheet

12/31/XX

| Assets |

|

|

Liabilities |

|

| Cash |

3,000 |

|

Trade Accounts Payable |

169,000 |

| Accounts Receivable |

80,000 |

|

Short-Term Notes Payable |

67,000 |

| Inventory |

252,000 |

|

Accrued Expenses |

40,000 |

| Total Current Assets |

335,000 |

|

Total Current Liabilities |

276,000 |

| Furniture & Equipment |

38,000 |

|

Long-Term Liabilities |

-0- |

| Accumulated Dereciation |

(12,000) |

|

Total Liabilities |

276,000 |

| Net Fixed Assets |

26,000 |

|

Equity |

|

| |

|

|

Capital Stock |

75,000 |

| |

|

|

Retained Earnings |

10,000 |

| |

|

|

Total Equity |

85,000 |

| |

|

|

|

|

| Total Assets |

$361,000 |

|

Total Liabilities + Equity |

$361,000 |

Notice how the two balance sheets compare.

- Retained earnings increased from $2,000 to $10,000;

- the assets increased $6,000

- the debts decreased $2,000

- and, again, the balance sheet balances.

Why Does "The Bottom Line" Matter?

Why do you need profit? To gain financial strength.

So you, rather than the banks, suppliers and other creditors, can actually own at least half of the assets in your business.

Knowing and controlling your bottom line makes for a financially stronger business—one you can bet your bottom dollar on.

©Copyright, The Retail Owners Institute® and Outcalt & Johnson: Retail Strategists, LLC.